Bad Timing for Wind Exports?

© Larry Hughes, 2026

Published allnovascotia.com

27 January 2026

Brian Flinn's article "Bad Timing for Wind Exports" (ANS, 21 Jan 2026) notes that "it is a poor time to consider generating new power for our unreliable and menacing neighbour [the United States]."

Maybe.

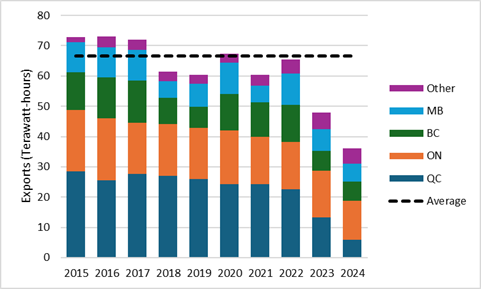

Between 2015 and 2024, electricity exports to the United States nearly halved because of drought conditions and wildfires in 2023 and 2024. Quebec, historically Canada's largest electricity exporter, experienced the largest decline.

Canada's electricity exports to the United States 2015-2024 (Author's chart; Data from StatsCan)

Most of Quebec's electricity exports go to the New England states. If Quebec is unable to meet this demand, renewable energy from offshore wind might be able to replace it.

However, given President Trump's ambition to make Canada the 51st state through economic coercion, blocking imports of electricity from Canada would short-circuit any offshore-wind export ambitions.

Quebec's new energy system

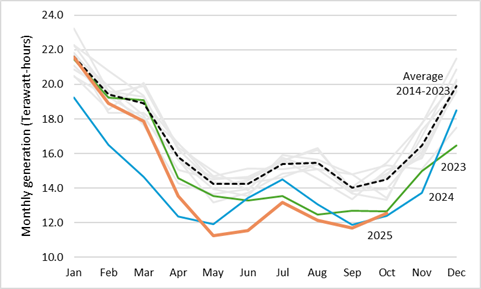

Quebec's declining exports are the result of Hydro Québec generating less electricity from its hydroelectric sites because of low reservoir levels.

Hydro Québec's monthly generation from 2014 to October 2025 (Author's chart; Data from StatsCan)

Hydro Québec's shortfalls come at an inopportune time for Quebec because of its plans for the electrification of the province as part of its effort to restructure its energy system. This will require sectors such as transportation, industry, and buildings to transition from oil products and natural gas to electricity.

Part of the restructuring involves reducing the energy demand in existing buildings and industries; replacing older, inefficient electric heating systems with new systems using, for example, heat pumps; and changing the rate structure to encourage less energy-intensive consumer behaviour.

There will be an increase in electricity demand as energy services such as gasoline and diesel vehicles transition to electricity, and as new industrial energy demand is met by electricity.

The transition is projected to increase demand for electricity from Hydro-Québec by 60 terawatt-hours by 2035 and between 150 and 200 terawatt-hours by 2050.

Work has already commenced on meeting the 2035 target.

For example, in July 2024, Hydro-Québec, several Indigenous communities, and private investors announced plans for a $9 billion, three-gigawatt windfarm to be located west of Saguenay-Lac-St. Jean. About 600 wind turbines are expected to be installed on a 5,000-hectare site.

Hydro-Québec is also looking for additional sources of electricity outside the province. It needs to renegotiate its controversial Churchill Falls contract with Newfoundland and Labrador Hydro by 2041 to ensure a reliable supply of electricity. Quebec is also interested in accessing electricity from the long-promised Gull Island hydroelectric project in Labrador.

As Michael Godwin, one of my former graduate students has shown, electricity from offshore wind could be shipped from Nova Scotia to Quebec by submarine cable.

Other markets

If Quebec or other provinces are unable to take the volumes of electricity from offshore wind that Premier Houston is promoting, other markets will need to be found, for example:

• Producing green hydrogen and shipping it, in the form of ammonia, to Europe now that the EU has agreed to let Canada partake in its green hydrogen market.

• Exporting electricity from Canada to Europe via high-voltage direct-current submarine cables.

Of course, such exports to Europe or elsewhere could be at risk from "our unreliable and menacing neighbour" because submarine cables can be cut (as is occurring in the Baltic) and tankers carrying ammonia (or any other energy source) can be stopped and seized (as is happening to Venezuela).

And if none of those threats come to pass, there is still the increased risk of hurricanes on the Scotian Shelf because of climate change.