A Made-in-Nova Scotia Carbon-Payment System

Larry Hughes

20 February 2024

In the summer of 2022, Premier Houston's arguments for a "Made in Nova Scotia" carbon-pricing system for the province were rejected by the federal government.

Consequently, Nova Scotia became part of the Canada's carbon pricing system on July 1st 2023.

The system consists of two parts.

First, a tax on carbon-intensive energy sources such as gasoline, diesel, home heating oil, natural gas, propane, and electricity.

And second, a payment, the Climate Action Incentive Payment or CAIP, paid every three months to households (that is, individuals and families) that have filed their previous year's federal income tax. The value of the CAIP is based on the number of people in the household, their province or territory, and where they live in the province.

The carbon pricing system has been very poorly explained by the federal government, with many people claiming they have never received the CAIP. That being said, the following table lists the total 2023-24 CAIP values for urban and rural households in Nova Scotia.

The value of the 2023-24 CAIP for households in Nova Scotia (prorated to full year)

|

|

Number of people in household |

||||

|

One person |

Two persons |

Three persons |

Four persons |

Five persons |

|

|

2023-24 urban CAIP |

$496 |

$744 |

$868 |

$992 |

$1,116 |

|

2023-24 rural CAIP |

$546 |

$818 |

$955 |

$1,091 |

$1,228 |

The carbon tax raises the cost of energy, while the CAIP is intended to offset the cost. Ideally, the CAIP equals the total cost of the tax, and the result is zero.

However, in some cases, households receive more than they pay and others receive less.

The problem

According to Environment and Climate Change Canada, "... carbon pricing is about recognizing the cost of [carbon] pollution and accounting for those costs in daily decisions".

Sounds reasonable.

Ideally, low- and moderate-income Nova Scotians would recognize that there a price on carbon and higher-income Nova Scotians would account for those costs in their daily decisions.

However, in some situations in Nova Scotia, this is reversed.

For example, a four-person family living in an energy-efficient home, driving an electric vehicle, and heating with a heat pump pays far less carbon tax than the same size of family living in an older, less energy-efficient home, driving a gasoline vehicle, and heating with oil.

Despite this, both receive the same Climate Action Incentive Payment (CAIP).

The question is, can the carbon-pricing system be kept while addressing this problem?

An alternative carbon-payment system

A fairer and more progressive alternative to the existing federal payment system would see low- and moderate-income households receiving at least the full CAIP and higher-income households receiving a smaller CAIP.

In the alternative carbon-payment system, the value of the CAIP depends on the number of people in the household and the household's income.

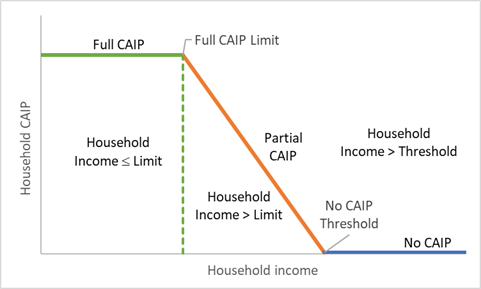

The basic structure of the system is shown in the following figure.

Households with incomes below the Full CAIP Limit receive the maximum CAIP value.

Households with incomes greater than the Full CAIP Limit receive a partial CAIP. The partial CAIP declines as the household income increases.

When the household's income exceeds the No CAIP Threshold, the value of the CAIP is zero.

The structure of the alternative carbon-payment system

The value of the Full CAIP Limit is determined by the Low-Income Cut-Off or LICO for the size of the household. (LICO is the income threshold below which a family is expected to devote at least 20% more of its income on the necessities of food, shelter, and clothing than an average family of the same size living in a similarly sized Canadian community.)

The most recent LICO (for 2021) for households in communities with populations between 100,000 and 499,999 are listed in the following table:

The before-tax Low-Income Cut-Off for differing sized households for communities with populations between 100,000 and 499,999

|

Number of people in household |

LICO |

|

1 person |

$23,696 |

|

2 persons |

$29,498 |

|

3 persons |

$36,265 |

|

4 persons |

$44,031 |

|

5 persons |

$49,938 |

|

6 persons |

$56,323 |

|

7 persons |

$62,707 |

The Partial CAIP decline rate is the rate at which the CAIP decreases with respect to the growth in household income; for example, the CAIP reduces by one dollar for every $100 of income above the Full CAIP Limit.

The value of the Full CAIP Limit and the decline rate of the Partial CAIP would be decided by the jurisdiction.

Example

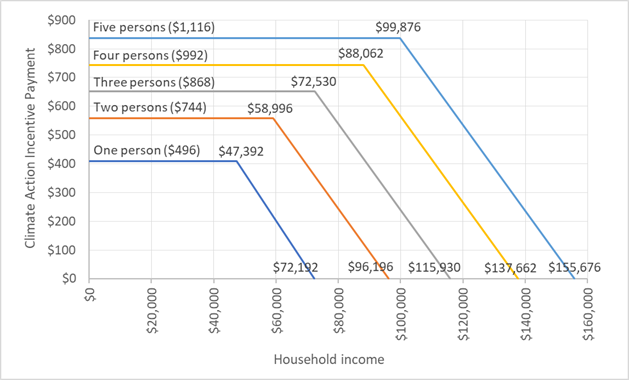

The next figure shows how the alternative carbon-payment system could work in Nova Scotia using the 2023-24 CAIP values. In this example, the Full CAIP Limit is twice the LICO value for the household. The Partial CAIP is reduced by $1 for every $50 of income above the Limit.

The alternative carbon payment system showing the maximum values of the Full CAIP Limit and the No CAIP Threshold for five sizes of urban household

Currently, all Nova Scotian households receive the full CAIP based on the number of members in the household. For example, a four-person urban household receives $744, regardless of income.

In the alternative system, four-person households earning less than $88,062 receive the maximum CAIP value of $744, while households earning more than $137,662 receive no CAIP.

Households between the CAIP Limit and CAIP Threshold receive a fraction of the CAIP.

For example, a four-person household with an income of $100,000 is $11,938 over the Full CAIP Limit of $88,062. Since the CAIP declines by $1 for every $50 over the Limit, the reduction is $239 (from $11,938 divided by $50). The household CAIP for 2023-24 would be $753 rather than $992.

If all Nova Scotian households (both urban and rural) filed federal income taxes, then about 51% of urban and rural households would receive the full CAIP, about 25% would receive a partial CAIP, and about 24% would not receive the CAIP.

Both the CAIP and No CAIP Thresholds for rural households are higher than urban.

A "Made in Nova Scotia" carbon-pricing system

In the example shown, the difference between the existing federal carbon-payment system and alternative system is about $140 million. These funds could be used to help low- and moderate-income household reduce their carbon tax further by, for example, helping offset the cost of winter heating for households in need, expanding the free heat pump program, and supporting existing residential building upgrade programs.

The alternative carbon-pricing system meets the federal government's goal of the carbon tax, it lets low- and moderate-income Nova Scotians recognize the cost of their carbon emissions and lets high-income Nova Scotians account for those costs in their daily decisions.

The federal government should have no reason to reject the alternative carbon-pricing system if Nova Scotia adopted it. They accepted British Columbia's carbon tax and payment system, which is similar to the alternative system described here.

Plus, it is made in Nova Scotia.

Published: allnovascotia.com, 20 February 2024