An alternative to Nova Scotia's carbon-pricing system

Larry Hughes, PhD

Electrical and Computer Engineering

Dalhousie University

Halifax, Nova Scotia

Introduction

Nova Scotians, like Canadians in seven other provinces and two

of the territories, are subject to the federal

carbon-pricing system.

The system consists of two parts. First, a tax on carbon-intensive

energy sources such as gasoline, diesel, home heating oil, natural gas and

propane, and electricity. And second, a cheque, the Climate Action Incentive

Payment or CAIP,

paid every three months to households (that is, individuals and families) who

have filed their previous year's federal income tax. The value of the CAIP is based

on the number of people in the household, their province, and where they live

in the province.

The carbon tax raises the cost of energy, while the CAIP is

intended to offset the cost. Ideally, the CAIP equals the total cost of the tax,

and the result is zero.

Which raises the question, if the result is zero, why have a

carbon-pricing system?

The answer, according to Environment

and Climate Change Canada, is "... carbon pricing is

about recognizing the cost of pollution and accounting for those costs in daily

decisions".

However, the cost of the carbon tax is not always offset by

the CAIP. By the federal Department of Finance's own estimates,

"8 out of 10 households [are] getting more money back than they pay".

For a household to get back more than its

pays, can mean living in a well-insulated house heated with a low-energy heating

system (such as a heat pump) or using a low-emissions vehicle (such as a hybrid

or electric vehicle), or both.

Low- and moderate-income households requiring

emissions-intensive energy sources for heating (such as heating oil) and

driving an older, gasoline-powered vehicle must take the carbon price into

account if they want to get back more money than they pay.

The original design of the federal carbon-pricing

system for Nova Scotia meant that families living in older homes using oil heating

paid a considerably higher carbon tax than families living in R2000 homes

heated with electric heat pumps. In some cases, the carbon tax would have

required families living in older homes to pay several hundred dollars more than

their CAIP.

Prime Minister Trudeau's solution to the

CAIP shortfall for oil-heated homes in Nova Scotia and other provinces

(primarily those in Atlantic Canada) was to remove or "carve

out" the carbon tax on home heating fuel for the

next three years.

Since households in Atlantic Canada stood

to gain the most from the prime minister's decision, governments in Alberta and Saskatchewan demanded the same treatment

for households in their provinces.

Despite refusing to make any other changes

to the federal carbon-pricing system, the prime minister's decision to

make the heating oil carve out has played into the hands of those wanting to "axe

the tax".

Fortunately, there is at least one alternative to the design

of the present carbon-pricing system that can help low- and moderate-income Canadians

and still let Canadians recognize the cost of pollution and account for the

costs in their daily decisions.

The problem with the existing carbon-pricing system

The federal government's fuel pricing

system consists of two parts:

The carbon tax, a fuel charge, which is applied to all

carbon-intensive energy sources. This year it is $65/tonne.

The Climate Action Incentive Payment, or CAIP, which is intended to equal

or exceed the total carbon taxes a household would pay on emissions from space

and water heating, electricity, and personal transportation. It is paid

quarterly and intended to cover carbon taxes for the upcoming three months.

The incentive payment varies by province,

family size, and where people live. A rural household currently receives

10-per-cent more than an urban household.

The carbon pricing system works best when most households have

similar energy demands using the same energy sources, such as natural gas for

heating and gasoline for transportation. When this is the case, the CAIP covers

the carbon tax on most households.

However, the carbon-pricing system breaks down in a jurisdiction

where there are several different energy sources with significantly different

emissions intensities being used for home space and water heating. For example,

in Nova

Scotia, about 55% of households use electricity and 33% use heating oil,

whereas in Alberta

and Saskatchewan,

over 85% of the households use natural gas and about 13% use electricity.

Although about 45% of Nova Scotia's electricity was

generated from coal and petcoke in 2022, the federal government's

Output-Based

Pricing System (OBPS) means that electrically heated homes pay a considerably

lower

carbon tax than homes using heating oil.

Low- and moderate-income Nova Scotian households are the

predominant users of heating

oil in the province. These households can face financial hardships if their

carbon tax exceeds their CAIP. Moreover, households with incomes that prevent them

from taking advantage of free heat pump programs

or benefitting from subsidies

on electric vehicles are caught in a bind.

The Climate Action Incentive Payment

The existing carbon-pricing system does not distinguish

between levels of income and the types of energy used by the household for heating

and transportation. The only distinctions made are the number of people living

in the household and its location (the CAIP for households in designated

rural areas is 10% greater than for a corresponding household in an urban

area).

We see this in Table 1, where all households, depending on

the number of residents, regardless of income, receive the same CAIP. For

example, a household with two adults and a child would receive $868 for an

urban household or $955 for a rural household.

Table

1: 2023-24 CAIP payments for households in Nova

Scotia (Prorated to four quarterly payments)

|

|

Number of people in

household

|

|

One person

|

Two persons

|

Three persons

|

Four persons

|

Five persons

|

|

2023-24 urban CAIP

|

$496

|

$744

|

$868

|

$992

|

$1,116

|

|

2023-24 rural CAIP

(10%

supplement)

|

$546

|

$818

|

$955

|

$1,091

|

$1,228

|

A simple modification to the CAIP would result in low- and

moderate-income households receiving the full CAIP and higher-income households

receiving a smaller CAIP.

The proposed alternative

Any alternative CAIP must be based on a

method that is understandable and uses known values.

In the proposed alternative, the value is obtained

from the Low-Income Cut-Off or LICO published by Statistics Canada. LICO is the income

threshold below which a family is expected to devote at least 20% more of its

income on the necessities of food, shelter, and clothing than an average family

of the same size living in a similarly sized community.

Low-Income Cut-Off (LICO)

Canada's LICO is not specific to a province

or territory, it is assumed to be applicable to all communities across the

country. However, LICO varies by size of community and the number of people in

a household. The most recent LICO (for 2021) for households in communities with

populations between 100,000 and 499,999 are listed in Table

2.

Table

2: Before-tax

Low-Income Cut-Off for differing sized households for communities with

populations between 100,000 and 499,999

|

Number of people in household

|

LICO

|

|

1 person

|

$23,696

|

|

2 persons

|

$29,498

|

|

3 persons

|

$36,265

|

|

4 persons

|

$44,031

|

|

5 persons

|

$49,938

|

|

6 persons

|

$56,323

|

|

7 persons

|

$62,707

|

LICO is used by governments and other

organizations to determine who qualifies for various assistance programs. Nova

Scotia's free heat pump program (HomeWarming.ca) uses the LICO values shown

in Table 2 plus a percentage (see Table

3).

Table

3: Household size and maximum allowable household income to qualify for Nova

Scotia's heat pump program

|

Number of people in household

|

Maximum household income

|

Maximum LICO value for household size

|

Percent over LICO

|

|

1

person

|

$27,800

|

$23,696

|

17%

|

|

2 to 4

people

|

$52,600

|

$44,031

|

19%

|

|

5 or

more people

|

$72,900

|

$62,707

|

16%

|

For example, the maximum allowable

household income for a four-person household to qualify for the heat program is

$52,600, or 19% above the four-person LICO of $44,031.

The alternative CAIP

Nova Scotia's heat pump program is an

either-or situation: Either the household qualifies because its income is below

the cutoff, or it does not qualify because its income is above the cutoff.

Unlike the province's all-or-nothing support for heat pumps,

the alternative CAIP proposed here has households with incomes below a certain

limit receive the full CAIP (this is the Full CAIP Limit). Households above

this point receive a partial CAIP that declines as their income increases (the

point at which the CAIP is zero is the No CAIP Threshold). The Full CAIP Limit is

determined from the LICO and depends on the number of people in the household. The

rate at which the CAIP declines is set by the jurisdiction; for example, a one-dollar

decrease in the CAIP for every $100 above the Full CAIP Limit.

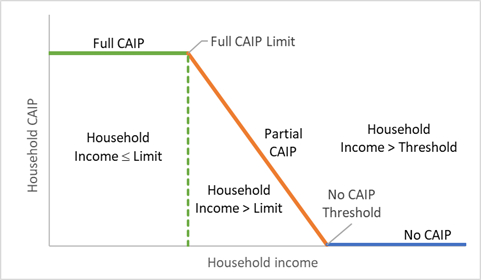

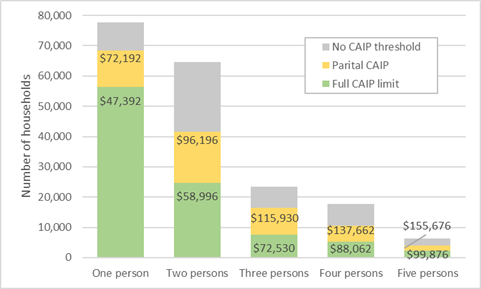

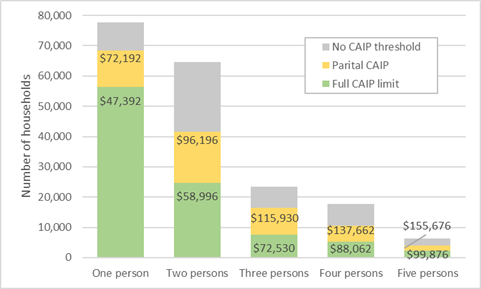

The structure of the alternative CAIP is shown in Figure 1.

Figure 1:

Structure of the alternative carbon-pricing system

CAIP limits and thresholds

The CAIP limits and thresholds are

determined by the LICO for a specific household size. The full value of the

CAIP is paid to the household as long as their income is less than the Full

CAIP Limit (a multiple of the LICO). When the Full CAIP Limit is reached, the

CAIP amount begins to decline (i.e., it is the Partial CAIP) until it reaches

zero (the No CAIP Threshold). The rate of decline is determined by the

jurisdiction. For example, a rapid decline would be a decrease of one dollar of

CAIP for every dollar over the Full CAIP Limit; whereas a slow decline would be

a decrease of one dollar of CAIP for every $50 over the Full CAIP Limit.

In Table

4, we see an example of three different Full CAIP Limits determined

by the value of the LICO multiplied by 1, 1.5, or 2 (that is, a zero percent

increase, a 50% increase, and a 100% increase). For example, a three-person

household has a LICO of $36,265, the Full CAIP Limit for this household would

be $36,265, $54,398, or $72,530 for LICO multiples of 1, 1.5, and 2.

In this example, the

CAIP reduces at a rate of one dollar for every $50 of income earned over the Full

CAIP Limit. For example, a household earning $500 over the Full CAIP limit

would see their CAIP decline by $10. The No CAIP Threshold is $79,665, $97,798,

and $115,930 for LICO multiples of 1, 1.5, and 2 for the three-person household.

Table

4: Examples of Nova Scotia's alternative CAIP values for different sized urban

households

|

Household size

|

LICO

|

LICO x 1

|

LICO x 1.5

|

LICO x 2

|

|

Full CAIP

Limit

|

No CAIP

Threshold

|

Full CAIP

Limit

|

No CAIP

Threshold

|

Full CAIP

Limit

|

No CAIP

Threshold

|

|

One person

|

$23,696

|

$23,696

|

$48,496

|

$35,544

|

$60,344

|

$47,392

|

$72,192

|

|

Two persons

|

$29,498

|

$29,498

|

$66,698

|

$44,247

|

$81,447

|

$58,996

|

$96,196

|

|

Three persons

|

$36,265

|

$36,265

|

$79,665

|

$54,398

|

$97,798

|

$72,530

|

$115,930

|

|

Four persons

|

$44,031

|

$44,031

|

$93,631

|

$66,047

|

$115,647

|

$88,062

|

$137,662

|

|

Five persons

|

$49,938

|

$49,938

|

$105,738

|

$74,907

|

$130,707

|

$99,876

|

$155,676

|

Applying the alternative CAIP to Nova Scotia

The alternative CAIP consists of three

parts. The CAIP itself, currently set by the federal government, although there

is no reason it couldn't be set by the province; the Full CAIP Limit; and the No

CAIP Threshold.

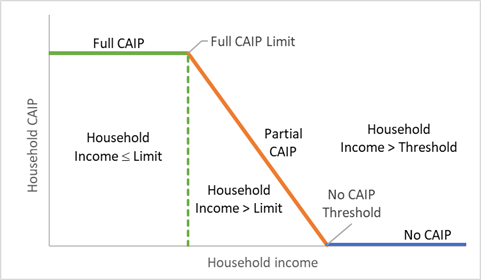

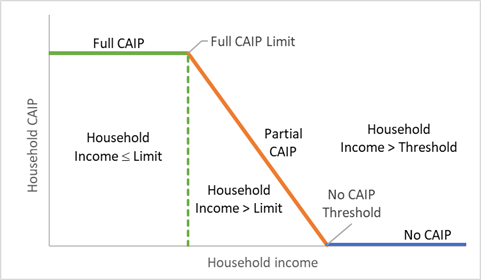

In the following examples, the Full CAIP

Limit is the value of LICO x 2

and the reduction rate is $1 in every $50.

The following figure is a graphical

representation of the alternative CAIP for LICO x 2 shown in Table

4. For example, a three-person family, would have a Full

CAIP Limit of $72,530 (double the three-person household LICO of $36,265). This

means that the family could have an income up to $72,530 before the CAIP is

reduced. The no CAIP threshold for the family is $115,930.

Figure 2:

Alternative CAIP showing urban household sizes, the household CAIPs (in

parenthesis), Full CAIP Limit, and No CAIP Threshold

Households with incomes between the Full CAIP Limit and the No

CAIP Threshold receive a partial CAIP. Calculating the partial CAIP is a three-step

process for both urban and rural households (this example uses urban household

values):

1. The difference between

the household's income and the Full CAIP Limit must be determined. The

difference for a three-person household with an income of, for example, $96,000

and the full CAIP limit ($72,530) is $23,470.

2. The difference

is divided by $50 to give the reduction in the CAIP. In the three-person

household example, the CAIP reduction is $469 ($23,470 divided by 50).

3. The partial CAIP

paid to the family is determined by subtracting the CAIP reduction from the

full CAIP. In this example, the household receives $399 (the household CAIP

value of $868 minus the reduction of $469).

The example shown here is for a Full CAIP

Limit of the LICO × 2 with a

reduction rate of $1 in every $50 earned over the Full CAIP Limit. Other limits

and reduction rates could be used. The example assumes that each household in

the province has the specified number of occupants and only one person in the

household receives the CAIP.

Currently, all Nova Scotian households with

at least one member paying income tax receives the full CAIP based on the

number of members in the household. In this example, it is assumed that all Nova

Scotia households, both urban and rural, pay income tax, and 40% of households

are urban and 60% are rural. This results in about 51% of all households

receiving the full CAIP, 25% receive a partial CAIP, and 24% receive no CAIP

(their incomes are above the No CAIP Threshold).

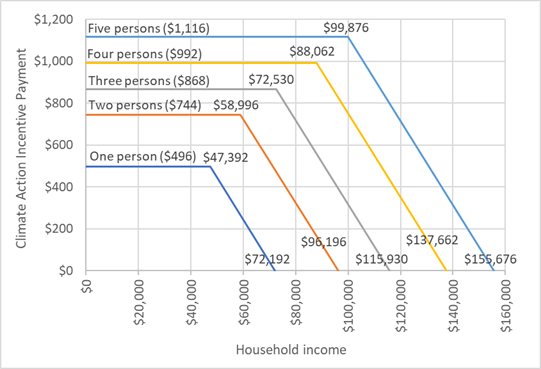

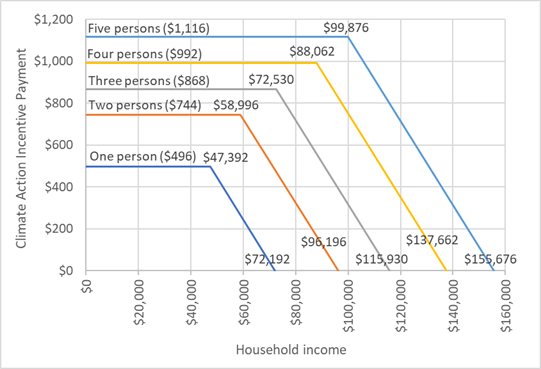

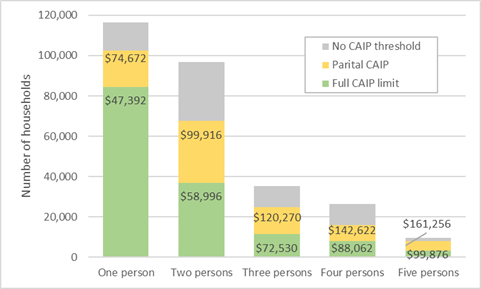

Figure 3 shows the number of urban and

rural households receiving full and partial CAIPs, and no CAIP. The Full CAIP Limit

is the same for the same size of urban and rural household (twice the LICO

value), but the No CAIP Threshold is different both for the size of household

and the CAIP, which is 10% higher for rural households.

|

|

|

Rural households by size and income limits for

Full-CAIP limit and No-CAIP threshold

(Total number of households is 284,550)

|

|

|

|

Urban households by size and income limits for

Full-CAIP limit and No-CAIP threshold

(Total number of households is 189,700)

|

Figure 3: Total number of rural (top) and urban (bottom)

households by household size and their maximum income limits for full-CAIP

limit and no-CAIP threshold (Statistics

Canada)

The carbon tax is unchanged and is still applied to all

purchases of carbon-intensive energy sources. The same revenues are collected.

However, in this example, the disposition of the carbon tax changes:

240,435 household receive the full CAIP; 119,740 receive the partial CAIP; and

114,075 do not receive the CAIP.

At present, assuming all urban and rural households receive

their full CAIP, it costs about $350 million.

If the alternative CAIP is used, it would cost about $210

million.

In this example, the difference between the current and

alternative system is about $140 million. These funds could be used to assist

low- and moderate-income household reduce their carbon tax by, for example, helping

offset the cost of winter heating for households in need, expanding the free

heat pump program, and supporting existing residential building upgrade programs.

Other carbon tax systems in Canada

There are two provinces with federally

approved carbon-pricing systems other than the federal carbon-pricing system:

Québec and British Columbia.

Québec

Québec is part of the Western Climate Initiative's Cap-and-Trade

system which includes California. Companies that are major emitters in the

system have emissions caps and are expected to pay for emissions above their

cap. This is done in an auction held every three months. The

cost of a company's emissions is passed on to the consumers when products are

purchased.

Unlike the federal system, this means the

price of, for example, a litre of gasoline, is not fixed for a year at 14.31

cents per litre (as it is in Nova Scotia and other provinces and territories

under the federal system), but can vary. The range of possible carbon prices

for commonly used fuels in Québec in 2023 are listed in Table

5 (minimum and maximum values determined from auction lower

and upper carbon price limits):

Table

5: Minimum and maximum possible carbon prices (cents per litre or cents per

m3) for 2023

|

Fuel

|

Minimum

|

Maximum

|

|

Gasoline

|

6.6

|

24.2

|

|

Diesel fuels

|

8.3

|

30.5

|

|

Light oil

|

7.6

|

27.9

|

|

Propane

|

4.3

|

15.7

|

|

Natural gas

|

5.2

|

19.2

|

The average carbon tax on gasoline in

Québec was about 9.23 cents per litre in 2023.

While this is about 5 cents per litre less

than Nova Scotia's carbon tax on gasoline, it is important to remember that Québec does not have a carbon-tax rebate

as we do in Nova Scotia.

British Columbia

British Columbia has a federally approved

carbon pricing system: a carbon tax on carbon-emitting energy sources

($65/tonne this fiscal year) and a quarterly rebated, the Climate Action Tax Credit (CATC).

CATC is similar to the CAIP in that it is

based on household size, the larger the household, the larger the CATC.

CATC is similar to the alternative CAIP

proposed for Nova Scotia, in that the CATC is determined by the household's income.

Like the alternative CAIP, when the income reaches the full CATC limit, it

starts to decline to the No-CATC threshold, at which point the household does

not receive the CATC.

The CATC value and income limits for

2023-24 are summarized in Table 6.

Table

6: BC's CATC

rebates and income limits

|

Number of people in household

|

Maximum CATC value

|

Income limits

|

|

Full CATC limit

|

No CATC threshold

|

|

Single

|

$447.00

|

$39,115

|

$61,465

|

|

Two

|

$670.50

|

$50,170

|

$83,695

|

|

Three

|

$782.00

|

$50,170

|

$89,270

|

|

Four

|

$893.50

|

$50,170

|

$94,845

|

|

Five

|

$1,005.00

|

$50,170

|

$100,420

|

There are a number of significant differences between the

example alternative CAIP for Nova Scotia example shown above and BC's CATC:

- Nova

Scotia's alternative CAIP is more generous than BC's CATC. For example, a three-person

household has a full CAIP of $868, whereas BC's CATC is $782.

- The

proposed alternative CAIP has higher income levels for those receiving the full

CAIP than does BC's CATC. In Nova Scotia, the Full CAIP Limit is a multiple of

the LICO, whereas in BC, the Full CATC Limit is $39,155 for single-person

households, and $50,170 for all other households, regardless of the number of

occupants.

- The

income at which no rebate is paid is also higher in the alternative CAIP than

in BC's CATC program. For example, in a four-person household, the alternative

full-CAIP limit is $88,062 and its no-CAIP threshold is $137,662, while BC's

CATC, the full-CATC limit is $50,170 and the no-CATC threshold is $94,845.

The future of Nova Scotia's carbon-pricing system

As the prime

minister's decision to remove the carbon tax from heating oil showed, Nova

Scotia needs an alternative to its current carbon-pricing system.

At present, all households receive the same

CAIP (based on the number of occupants) regardless of the energy they use for

heating and transportation. Households using electric heat pumps pay far less carbon

tax than comparable-sized ones using oil furnaces. Similarly, drivers of electric

vehicles pay far less carbon tax than those driving gasoline-powered vehicles.

In some cases, the CAIP is less than the

carbon tax paid by households using oil heat and driving

gasoline vehicles. Many of these are low- and moderate-income households.

This report has described a progressive

carbon-pricing system that meets the objectives of the federal system by retaining

the carbon-tax, helping Nova Scotians who need assistance with their energy

costs, and encouraging the purchase of low-emissions technology by those unable

to afford it.

This is in keeping with Environment

and Climate Change Canada's statement that carbon pricing is "about

recognizing the cost of pollution and accounting for those costs in daily

decisions".

In 2022, the premier wanted a Made-in-Nova-Scotia

carbon pricing system; it was rejected

by the federal government.

Since the federal government has accepted British Columbia's

carbon pricing system, they would have a hard time rejecting the alternative to

Nova Scotia's carbon-pricing system described in this report.

Plus, it is made in Nova Scotia.

Acknowledgements

The author of the report would like to

thank Michael Godwin, Sheheryar Mubarak, Sara Sohrabikhah, Augustine Okafor, and

Mike Shea for reviewing the report. Sandy Cook edited it. The author is solely responsible

for any mistakes.

The work in this report was not funded by either

the federal or provincial governments.