Carbon taxes in Nova Scotia

Larry Hughes, PhD

11 July 2023

The Department of Finance Canada's Climate Action Incentive Payment Amounts webpage shows that a family of four living in Nova Scotia will receive three quarterly payments of $248 for their carbon tax expenses between July 2023 and March 2024.

The question is, will the payments, totalling $744, cover these expenses?

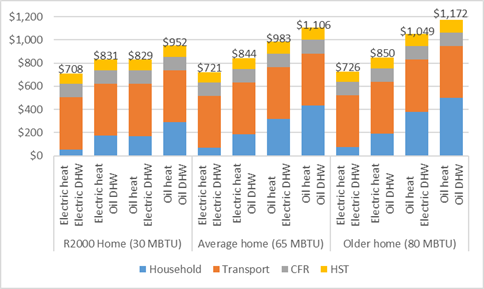

The cost of the carbon tax to the family depends on their home's heating and hot water demand and the energy used (either oil or electricity); their electricity demand for appliances and lighting; and their transportation fuel consumption.

My research has used energy data from Efficiency Nova Scotia for space heating demands in three types of home (R2000, Average, and Older) and a family of four's hot water demand. Data for electricity use and car and light-truck average fuel consumption is from Natural Resources Canada.

The carbon tax for heating fuel (used for space or water heating, or both) is 17.4 cents/litre.

The carbon tax on electricity is estimated to be less than half-a-cent/kilowatt-hour.

The carbon tax on gasoline is 14.3 cents/litre.

Although not considered to be part of the carbon tax, this analysis includes the Clean Fuel Regulations (CFR) and the HST.

The CFR adds 3.74 cents to every litre of gasoline sold.

The HST is applied to the carbon tax on the sale of gasoline (15%) and light fuel oil (only the 5% federal part).

The following chart shows the estimated lowest and highest cost of the taxes on the family of four's emissions in the three types of home between 1 July 2023 and 31 March 2024:

Of the twelve households examined, the R2000 home using electricity for heating and domestic hot water has the lowest total tax of $708. The highest is $1,172 for the older house using oil for heating and hot water.

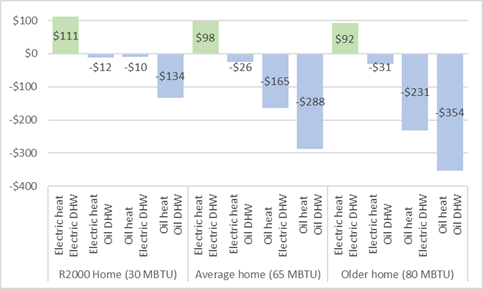

Every quarter, the federal government sends individuals and households a Climate Action Incentive Payment (CAIP) based on their expected carbon tax paid.

Between July 2023 and March 2024, a family of four living in Halifax or East Hants will receive a total CAIP of $744.

Nova Scotians living outside these areas receive an additional 10% rural supplement, increasing the CAIP for a family of four to $818.

The benefit of the CAIP to a family of four receiving the rural supplement, if applied to their total taxes for 2023-2024, is overwhelmingly dependent on the energy used for space and water heating:

When applied to households using electricity for heating and hot water, the CAIP results in a small profit (up to $111). However, in homes using oil for space or water heating, households faces losses ranging $12 to as much as $354 even with the application of CAIP.

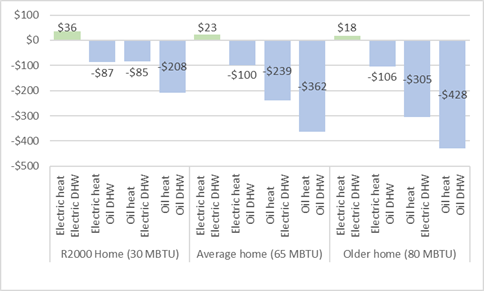

The effect of the taxes on households not receiving the rural supplement is much greater:

These are the direct impacts of the carbon-related taxes on a hypothetical family of four.

The carbon tax on other households will vary, depending on the family size, their heating systems, and transport requirements.

The federal carbon tax is intended to encourage Canadians to reduce their emissions by taking actions such as insulating their homes, purchasing a heat pump, or purchasing an electric vehicle.

Ideally, households would do these things. However, the cost of the taxes means taking these actions becomes increasingly difficult.

While blaming the federal government for this is easy, the provincial government must assume some responsibility.

After all, it had almost a year to develop programs to prepare Nova Scotians for the impending impact of the carbon tax.

Published allnovascotia.com 11 July 2023.